Astrea 7 bond

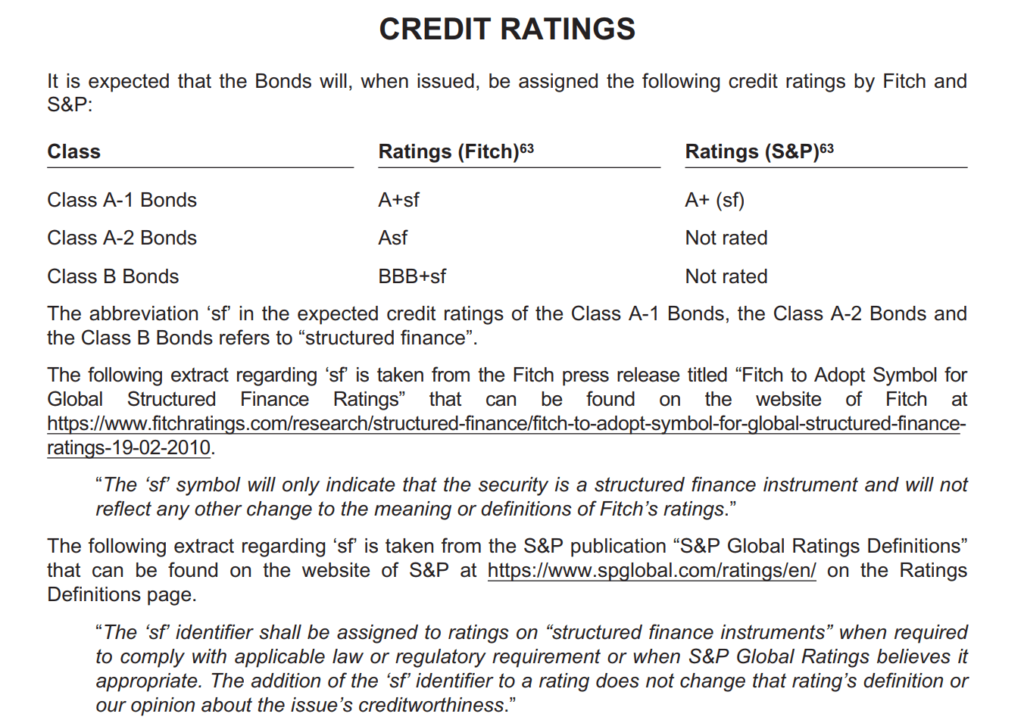

I noticed that the credit quality of Astrea 7 Class A-2 and B are lower than the Astrea 5 issue based on Fitch Rating. However we have to recognise that the current interest rate environment is lower than when Astrea IV and V were issued.

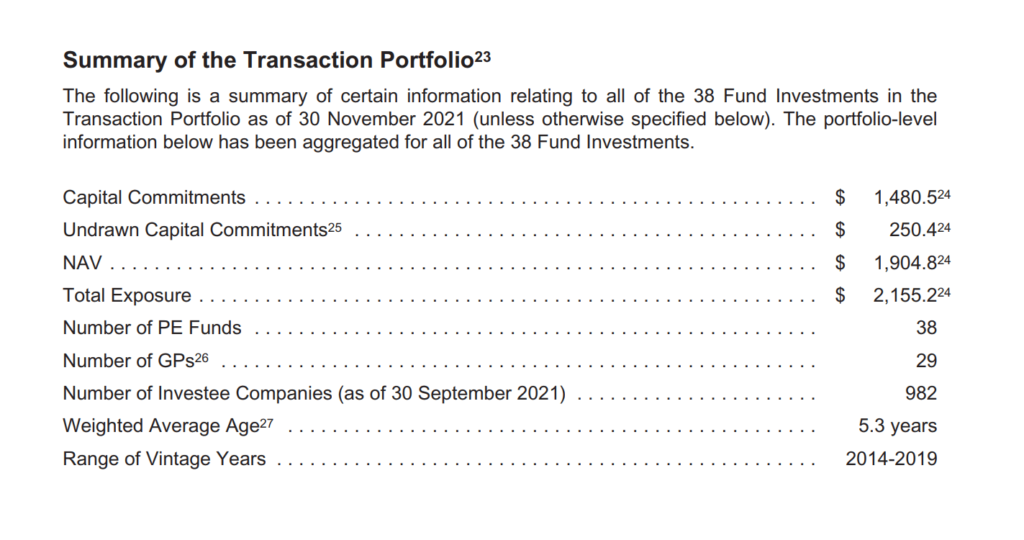

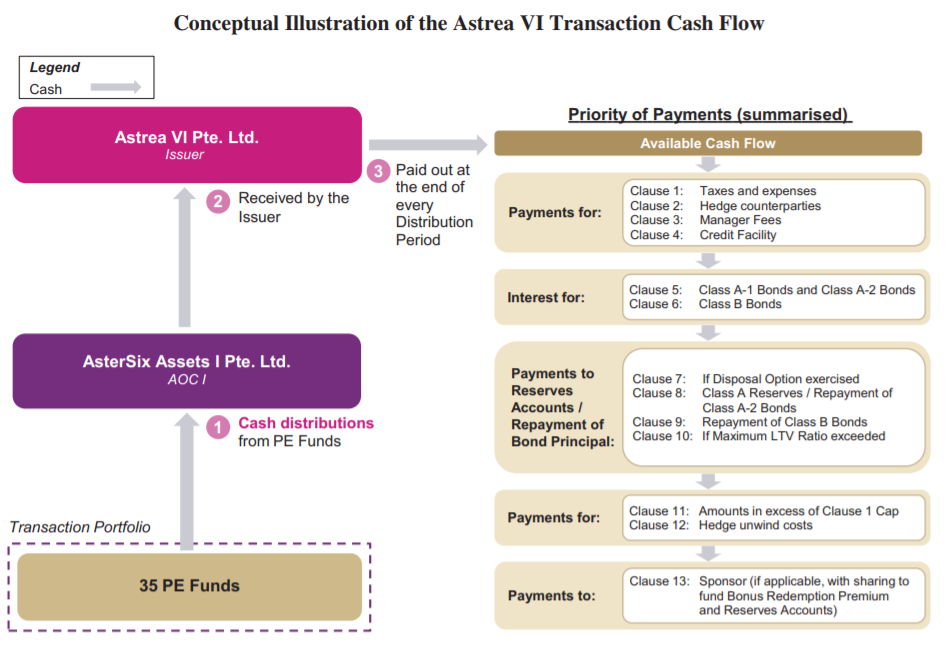

Astrea 7 marks the seventh series of asset-backed securities offered by the Group and the cash flows are backed by a portfolio of 38 private equity PE funds with over 982 investee companies.

. The proceeds will be used for refinancing of green assets according to its Green Financing Framework dated September 24 2020. The bonds received orders over 11bn 17x issue size. Retail investors can also apply for Class B bonds which pay a higher fixed interest rate of 6 per cent per annum.

Astrea is sponsored by Astrea Capital which is a wholly owned subsidiary of Azalea Asset Management which in turn is wholly owned by Singapore state-owned investment company. There will be two types of bonds available to retail investors. 1 day agoToday Azalea Asset Management has released the Astrea 7 bonds for application.

There will be two types of bonds available to retail investors. The size of the transaction is about 755mn or S105bn 396 of its underlying PE portfolio valued at 19bn. It is around 396 per cent of the underlying PE portfolio valued at US19 billion.

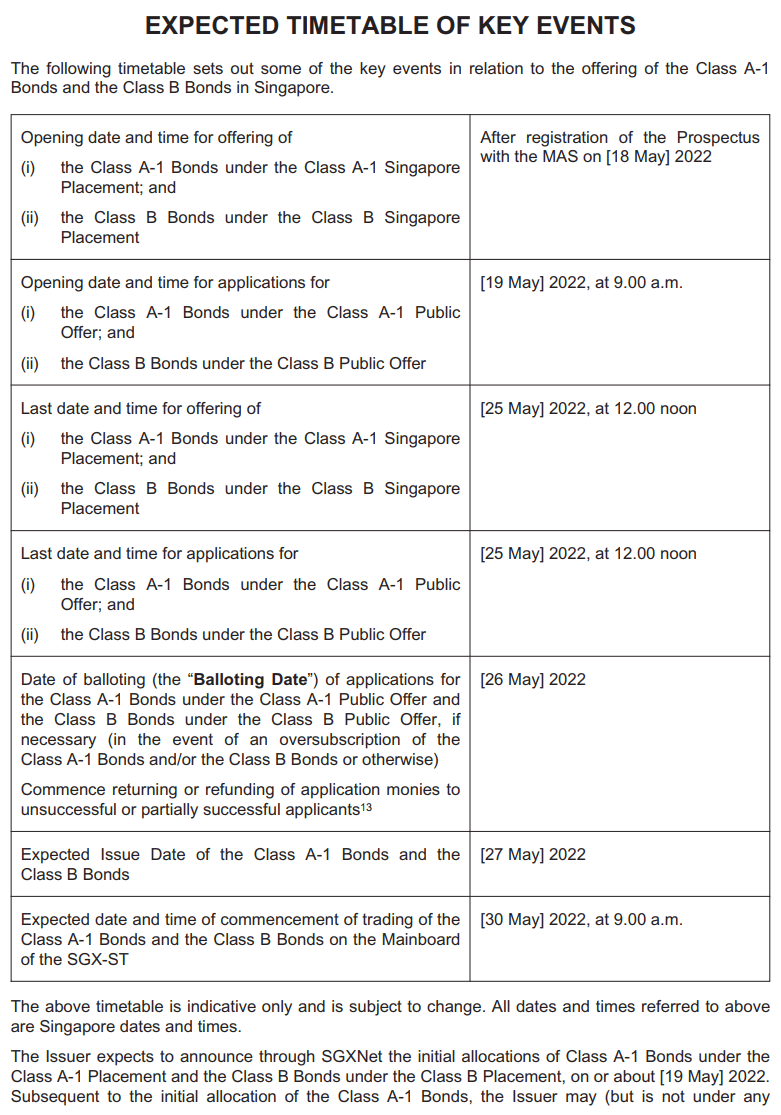

1 day agoThe public offer of Astrea 7 PE bonds comprises S280 million in Class A-1 bonds which pay a fixed interest rate of 4125 per cent per annum above the coupon for Class A-1 bonds in the previous Astrea V and VI issuances. It is offering 277 million of Class A-1 Bonds and US100 million 138 million of Class B Bonds to retail investors in Singapore. Today at 237 PM.

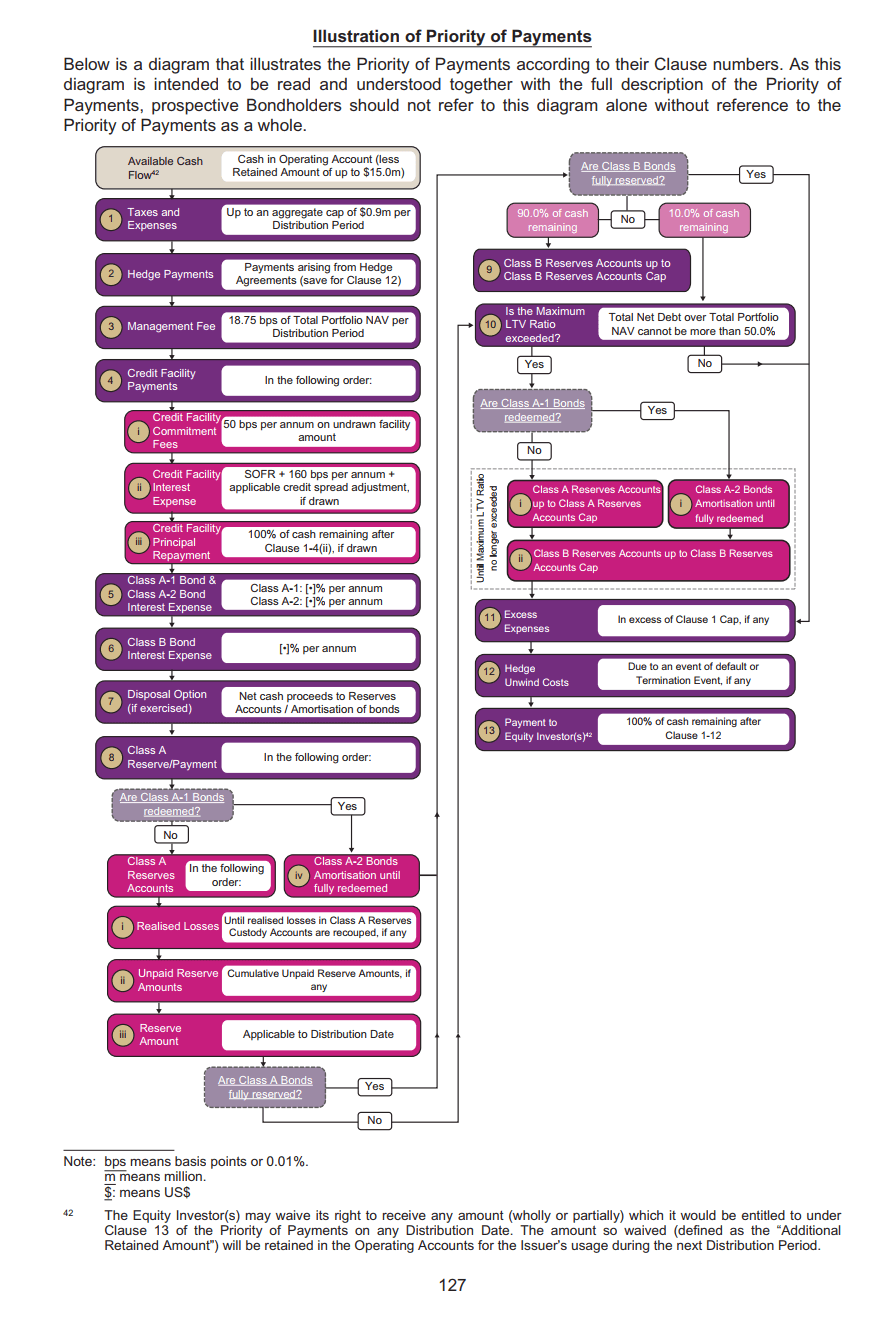

Astrea is a series of bonds that are issued by a holding company that also held private equity funds as assets. The issuance is expected to have three classes of bonds namely A-1 A-2 and B but only Class A-1 and Class B bonds will be made available to retail. The resizing of tranches resulted in slightly more negative cash flow modelling results for the A-1 bonds due to the higher LTV but did not materially change Fitchs overall analysis which supported todays affirmation of the.

14 hours agoOn 19 May 2022 Azalea Investment Management launched its latest batch of Astrea private equity PE bonds for public subscriptions. AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds. Similarly to the past launches there are three classes of bonds.

Class A-1 Bonds offering 4125 per annum and Class B. The reallocation of class A bond principal did not result in a change to the cumulative LTV of Astrea 7s rated bonds. AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds.

Its the easiest way to drink filtered water at school and on the go. Azalea is an indirect wholly-owned subsidiary of Temasek Holdings Private Limited with the aim is to make private equity accessible to retail investors as it usually require a high amount of investment capital. Astrea V 385 for Class A-1.

Astrea 7 is a private equity PE collateralized fund obligation CFO backed by interests in a diversified pool of alternative investment funds with approximately USD19 billion in net asset value NAV and. This will be the 4th bond from Azalea with. But aside from that the term of the Astrea 5 is shorter than the Astrea 7 but the yield is also lower so we cannot really assess the quality difference between Astrea 5 and 7.

On May 2 the Treasury Department announced that the inflation-protected I bonds will earn 962 percent interest at least until the end of October. Temasek-linked Astrea 7 is pricing three classes of private-equity bonds with public and institutional tranches according to a client note seen by Shenton Wire Wednesday. The astrea ONE filtering water bottle is the first to be certified to the NSF53 standard for lead reduction in drinking water.

Astrea 7 bond application begins today 20 may 22 at 9am. The quantum is subject to change because Astrea 7s prospectus is preliminary. A day later TreasuryDirect the.

Ltd a wholly-owned subsidiary of Azalea. Interest rates to be decided. Temaseks Azalea launches Astrea 7 PE-backed bonds.

The indicative total size of the new issuance called Astrea 7 is US755 million. When you compare this to when Astrea IV 435 and Astrea V 385 first offered its Class A-1 Bonds the interest is slightly lower. Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity FundsOnly Class A-1 and B bonds are available for application.

The reallocation of class A bond principal did not result in a change to the cumulative LTV of Astrea 7s rated bonds. In this issue of Astrea 7 the bonds is tied to 38 PE private equity funds. It also reduces Copper Mercury Zinc Chlorine Cadmium and Chromium.

Class A-1 Bonds with a fixed interest rate of 4125 per annum and Class B Bonds with a fixed interest rate of 6 per annum. Joined Jul 16 2020 Messages 15144 Reaction score 3988. Astrea is a series of bonds that are issued by a holding company that also held private equity funds as assets.

The bonds received orders over 3bn 6x issue size. Application will close on 25 May 2022 12pm. Astrea 7 or the issuer as seen in the table above.

Fitch Ratings expects to rate the class A-1 A-2 and B bonds to be issued by Astrea 7 Pte. The indicative total size of the new issuance called Astrea 7 is US755 million. The bonds will rely on the cash flow from the underlying companies in the private equity funds to pay the interest coupon.

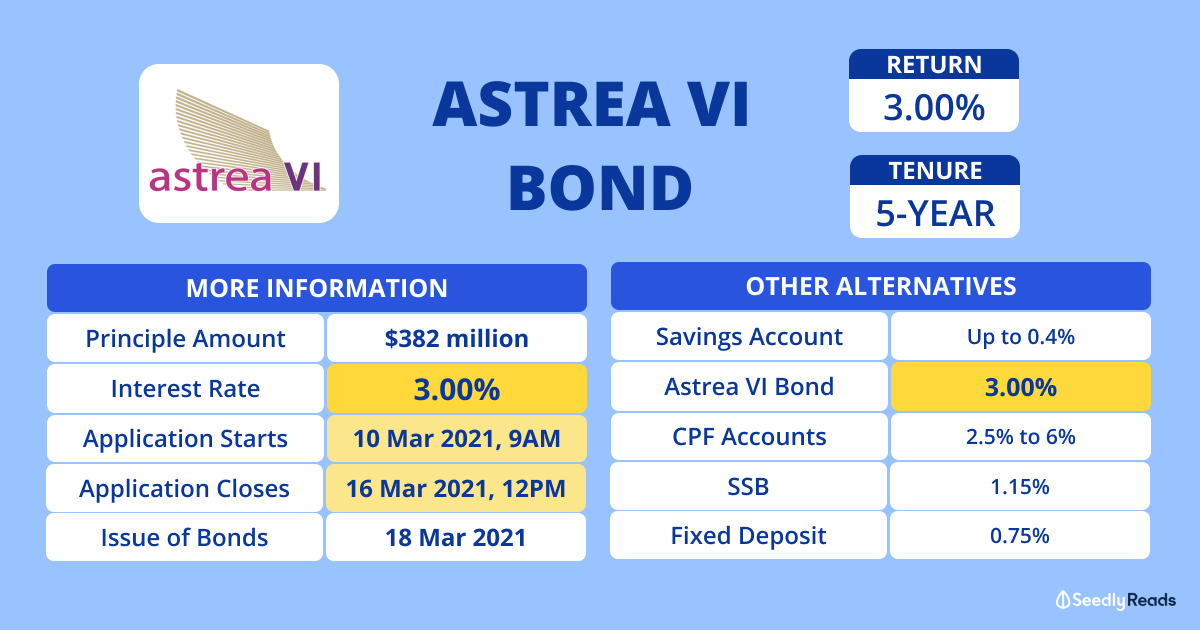

The new Astrea 7 Bonds are private equity bonds with Astrea 7 Bonds interest rates of up to 6 pa. Class A-1 Bonds of Astrea VI PE Bonds will pay investors 300 pa. It also raised 650mn via a 4NC3 bond at a yield of 4131 15bp inside initial guidance of UKT280bp area.

Temaseks indirect subsidiary Azalea has launched an Astrea 7 bond backed by 38 Private Equity PE funds. The indicative total size of the new issuance called Astrea 7 is US755 million. Here is all you need to know about them including risks and all.

Most likely the Astrea 5 bonds will be called back in 1 to 2 years. The initial price guidance for Class A-1 A-2 and B bonds are 4375 5625 and 6375 respectively but are also subject to change. Astrea VI bonds are issued by Astrea VI Pte.

Out of a total indicative size of USD 755m Class A-1 bonds will have an allocation of USD 380m SGD 526m while Class A-2 and B will have a. Astrea 7 Pte.

Astrea Vi Bonds At 3 Per Annum To Buy Or Not To Buy

Review Of Astrea V 3 85 Class A 1 Secured Bonds Worse Than Astrea Iv Financial Horse

Astrea Vi S Retail Tranche Of A 1 Launched At 3 Institutional Hni Tranches Placed Track Live Bond Prices Online With Bondevalue App Temasek Holdings Astrea Iv

Temasek S Azalea Launches Astrea 7 Pe Backed Bonds Interest Rates To Be Decided Banking Finance The Business Times